Corporate Korea, infamous for being stingy in returning profits to shareholders, is warming to investors with a sizable dividend boost this year, as its obsession with growth fades and a new law discouraging cash hoardings is being enforced.

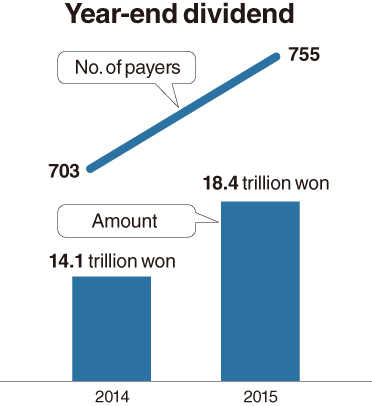

Year-end cash dividends are up 28 percent so far this year, pushing the total to a new record of over 18 trillion won ($14.9 billion), according to data from the bourse operator Korea Exchange.

A total of 755 companies listed on the country’s two main stock exchanges, KOSPI and KOSDAQ, either have already given out or plan to distribute cash dividends to shareholders for the fiscal year 2015. That is 52 companies more from a year ago. The total payout amount is 18.3 trillion won, compared to the previous year’s 14.1 trillion won.

“Dividends paid or pledged so far exceed market expectations,” said Choi Chang-gyu, analyst at NH Investment & Securities. “Dividends have proven to be a valid stock-picking strategy and will be again this year.”

Among some of the biggest capitulations, Samsung Electronics, the country’s top-cap stock, distributed 2.9 trillion won in dividends in January, as part of its policy to give more to shareholders. The electronics giant has pledged to return 30 to 50 percent of free cash flow to shareholders over the next three years. The state-run Korea Electric Power Corp. decided on a 2 trillion won dividend scheme for the year 2015, its largest allotment to date.

According to Choi Jin-hyuk of SK Securities, the trend of larger dividends will continue for a couple of years.

“Korea is having an unprecedented momentum for dividend growth, building from all sides — the market, investors, government and companies,” he said in a report last month.

With expectations low on the stock market’s overall performance, investors are likely to turn their attention to stock yields, demanding a bigger share of cash held at companies. At the vanguard of this is Korea’s largest investor, the National Pension Scheme, which last year officially adopted an action plan to increase its dividend income.

On top of this, a law, effective since last year, levies a special tax on companies that hold “excess” cash, encouraging them to spend more in investment, recruitment or shareholder returns. Many companies prefer dividend increases over new investment or recruitment at this time of economic hardship, Choi explained.

More fundamentally, perhaps, there is an underlying change in Koreans’ perception toward shareholder returns, some pundits say.

While meager dividend payouts were among the main complaints that global investors had about Korea for many years, the local public viewed shareholders demanding hefty dividends as short-term profit-takers who may hinder companies’ investment for future growth.

Among this years dividend payers, the ratio of mid- and small-cap firms has remarkably increased, a Korea Exchange official explained. “This reflects the shift toward improved shareholder returns is more broad-based.”

Korea’s dividend payout ratio stood at around 18 percent in 2014, far below the global average of 56 percent and the emerging-market average of 38.9 percent. Dividend yield was 1.3 percent in the year, also the lowest among major markets.

By Lee Sun-young

(milaya@heraldcorp.com)