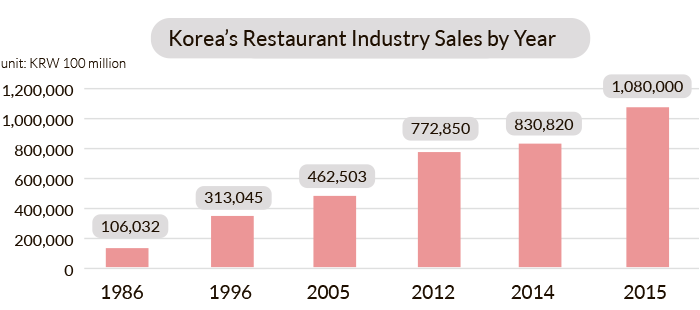

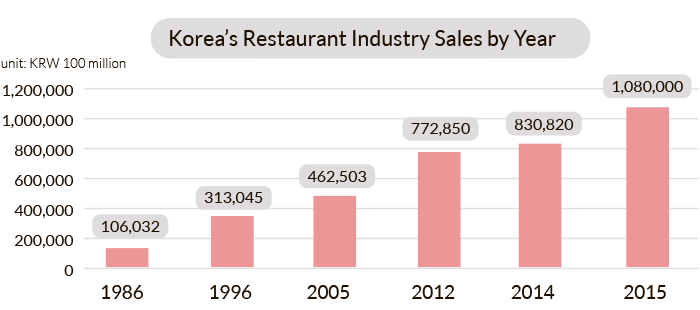

Scale of Korea’s restaurant and dessert markets

Korea’s restaurant industry witnessed a 233 percent rise in total annual sales from KRW 46.253 trillion (USD 46.35 billion) in 2005 to KRW 108 trillion in 2015.

Such growth was caused by socioeconomic and cultural factors, including higher income levels, more women working outside the home, more time being spent on recreational activities, changes in food and restaurant spending patterns and rise in one- to two-person households.

Source: Korea Food Service Almanac, Ministry of Agriculture, Food and Rural Affairs

As the diversification of consumer trends and changes in our lifestyle cause the restaurant industry to undergo further segmentation and specialization, bringing about continuous change in spending trends, one of the most notable changes is the growth, segmentation and specialization of the dessert industry.

In general, the dessert shop industry can be divided into coffee shops, bakeries (confectionaries and breads), ice cream parlors, tea and beverage shops and other dessert shops. Early on, markets formed around specialty stores such as bakeries, coffee shops and ice cream parlors, but later, with the expansion of café culture and with global brands like Starbucks entering the Korean market, the popularization of coffee and dessert shops and the diversification of consumer’s needs have led to the segmentation of business types, items and consumers, resulting in quantitative and qualitative market growth.

Korean dessert shop market consumer trends

The growth of Korea’s dessert market is mainly attributable to recent changes in consumer trends. Since 2010, the economic polarization caused by the extended recession has encouraged consumers to prefer cost effective “good value” products, or treat themselves to “small luxury” items or premium goods within an affordable range. Such a phenomenon has increased the demand for premium desserts that offer a sense of happiness through visual stimulation as well as sweetness.

As consumers in their twenties and thirties, the most avid followers of this trend, highly value outward appearance and expression of individuality, they are inclined to advertise their spending behavior through online blogs and other social media sites. As such, visually stunning desserts keep growing in demand as their photos travel through social media to create a word-of-mouth marketing effect.

According to a survey on general consumers in 2016, there was little difference between the number of consumers who spent more on eating out than during the previous year (50.8%) and those who spent less (49.2%). There was also a 25.9-percentage-point gap between those who increased their year-on-year spending at dessert shops (56.3%) and those whose spending decreased (30.4%), showing that the share of desserts continues to grow in the food services industry.

Then what are some of the reasons consumers visit dessert shops? One survey shows that consumers don’t think of dessert shops merely as places to buy food, but as a space that can be used for various purposes, such as reading, studying, socializing and spending time alone. That is, dessert shops have meaningful places that add value to the lives of today’s consumers.

Source: “Survey on Korean and Foreign Dessert Food Service Markets” Ministry of Agriculture, Food and Rural Affairs / aT Korea Agro-Fisheries & Food Trade Corp. (2016)

A look at the entire dessert consuming population revealed that women more so than men, Seoul residents more so than non-Seoul residents, and younger rather than older consumers bought a wider variety of desserts and more frequently.

According to a survey, bakeries topped the list in the frequency of visits and preference, followed by coffee shops, ice cream parlors, beverage and tea shops and other dessert shops, and in that order. In general, the same was also true for the number of purchases per month and intent for future purchases. By item, confections, beverages and teas (fruit juices, smoothies, teas, bubble teas, other beverages, etc.), and ice cream were preferred by younger consumers, while coffee was preferred by older consumers. Korean desserts such as tteok (rice cakes) were preferred by older male consumers, and it is worth noting that consumers would recognize a dessert item as Korean based not on the type of dessert, but rather on whether it contained a Korean ingredient like persimmon, red bean or sticky rice.

Prospects of Korea’s dessert shop industry

Based on a comprehensive analysis of the current status and trends of Korea’s food service industry as well as dessert consumption behavior, the dessert shop industry is expected to continue on its path of growth. However, considering that many still see dessert items as ‘expensive’ and ‘unreasonably priced,’ the growth is thought to be accompanied by further structural polarization between the low-end, low-priced market and the high-end, premium market that uses unique quality ingredients. And as with all trends, the focus on showiness is expected to die out, giving way for desserts to become a natural part of our daily lives.

-Bakeries and bakery cafés

As bread consumption continues to grow with the westernization of our diet, the rise of one-person households and a busy modern lifestyle, the domestic retail bakeries market in 2014 reached KRW 4.6 trillion (USD 4.21 billion) in sales, up 60 percent from 2009.

In the early stages, the market began to form around individually-owned bakeries, but later more consumers began to prefer famous brands and have high standards for hygiene and quality control. Also, since 2011 corporate-type bakery franchises started to exceed individually-owned bakeries in number of stores. However, consumers now are beginning to value gourmet and healthy food, raising the demand for chef-owned pastry shops that stand out for using high-quality ingredients and advanced techniques. The industry’s competitive structure is expected to maintain the division between bakery franchises armed with popular appeal and convenience (accessibility, etc.) and individually-owned bakeries that give priority to quality and value.

-Coffee shops

The first specialty coffee shops opened throughout Korea in the 1980s with the introduction of the franchise system, and a new culture of espresso-based take-out coffee spread across the country with the opening of the first Starbucks store in 1999. The coffee market has seen exponential growth since the turn of the century, as evidenced by the increase in foreign companies as well as Korean brands. In particular, the emergence of low-priced coffee franchises in and around 2014 has sparked fierce competition in the market.

As of 2014, the domestic coffee market (including instant coffee, bottled coffee drinks and coffee shops) amounts to KRW 5.4 trillion (USD 4.95 billion) and the coffee shop market alone amounts to KRW 2.5 trillion, or about 47 percent of the entire coffee market.

Meanwhile, to meet the diverse needs that arise as the coffee shop market continues to grow, a new market of individually-owned coffee shops has started to pop up during the past few years. These individual brands can be divided into low-priced coffee shops targeting the local community and premium coffee shops that target coffee connoisseurs. The latter is a segment of the evolving coffee shop market that emerged in response to the rising demand for high-end products. By using select beans and roasting methods, such shops have formed a new market that separates itself from the standardized tastes of large franchises. In other words, while many consumers are still unwilling to pay too much for a cup of coffee, there is also an increasing number of coffee drinkers who constantly crave higher-end products.

-Beverage and tea shops

The market for general beverages and teas is being formed as non-coffee beverages are being marketed as coffee alternatives. These beverages are being marketed with keywords like “health” and “beauty” or as meal replacements mixed with various health ingredients. Most businesses in this industry are either corporate franchise chains or premium boutiques. In the past, premium shops had been the focus of the early market formation, upon which the focus shifted to the mid- to low-priced corporate franchise brands, but today the two types co-exist in the current market.

In 2016, there were 53 beverage and tea franchise brands in Korea, an approximately 6.7-fold increase from 2013. As such, while they might not grow at quite the speed of coffee shops, stores that specialize in fresh fruit juices and smoothies, leaf teas and bubble teas, yogurts and other non-coffee beverages are expected to remain at the core of the industry.

-Other dessert shops

The ice cream market, too, has been divided into the mid- to low-priced market and the premium market based on high-end ingredients. Meanwhile, the bingsu (shaved ice) industry managed to enter foreign markets as a major dessert item with the emergence of specialty bingsu stores. Now growth has slowed for various reasons, including it being affected by the changing of seasons.

Rice cake, macaron, chocolate and popcorn shops are also forming small but significant dessert markets as they position themselves as high-priced premium stores that use high-quality ingredients and the latest manufacturing technology to make items daily at the store from scratch, targeting a small number of dessert connoisseurs as opposed to the general public. In particular, the positive demand for Korean desserts represented by the popularity of bingsu, along with the trend of more diverse and expensive tteok items, is expected to lead to additional consumer markets for various Korean beverages and desserts.

By Eun Ok Youn

General Manager, Korea Foodservice Industry Research Institute / yeo@foodbank.co.kr